Location: Ho Chi Minh City, Vietnam

Job type: Permanent - Full Time

Work style: Hybrid Working

Opening date: 07-Oct-2024

Closing date: 31-Oct-2024

Job Advert Details

Some Careers Grow Faster Than Others.

If you’re looking for a career that will give you plenty of opportunities to develop, join HSBC and your future will be rich with potential. Whether you want a career that could take you to the top, or simply take you in an exciting new direction, HSBC offers opportunities, support and rewards that will take you further.

Wealth and Personal Banking (WPB) is our new global business combining Retail Banking and Wealth Management; and Global Private Banking, to become one of the world’s largest global wealth managers with USD1.4 trillion in assets. Our dedicated colleagues serve millions of customers worldwide across the entire spectrum of private wealth, ranging from personal banking for individuals and families, through to business owners, investors and ultra-high-net-worth individuals. We provide products and services such as bank accounts, credit cards, personal loans and mortgages, as well as asset management, insurance, wealth management and private banking, that best suit our customers’ needs.

We are currently seeking a high calibre professional to join our team as an Business FCR Manager.

Job Purpose

Support the Head of WPB Business FCR in the execution of various underlying Global Standard programme components in the business including Data Readiness, Customer Due Diligence, Anti-Money Laundering and Sanctions Policy roll out/embedding and leverage those components to the transition of Global Standard programme to Business As Usual together with FCR streamline & simplification. The roles are also accountable for ensuring adequate controls are in place to manage financial crime risk and will be subject matter expertise providing guidance and advising the businesses on managing financial crime risk to ensure WPB's compliance to both global policies and local laws, rules and regulations relating to financial crimes.

The job holder will have to work with multiple entities and stakeholders across the organization (regional and global interaction) to deliver on this critical/strategic programme.

Principal Responsibilities

Impact on the Business/Function

- Successful and sustainable implement and transit to BAU the Global Standards projects across Wealth and Personal Banking (WPB)Be responsible for relationship/project managing a number of WPB projects including FCR project streamline and simplification

- Monitor progress to ensure programs are delivered on time and business results / outcomes are up to the expectation

- Be responsible for instilling project disciplines, including controlling execution, and change control

- Identify and escalate any issues or potential risk relating to FCR

- Observe and provide recommendation to ensure the local procedures / guidance aligned with Global and Regional FCR policies and local regulation.

- Identify synergy in aligning new and old processes.

- Manage and review processes to identify quality issues

- Act in an advisory role in term of FCR

- Analyze solutions provided by delivery partners to ensure integrity of solution and any risk or impact is manageable or can be mitigated

- Thorough understanding of local Regulatory guidelines

- Timely execution and delivery of WPB owned Regulatory projets along with embedding across policies.

- Suggest ideas and contribute to implementing actions that will improve customer service, quality or the way teams and individuals work together.

- Adhere to HSBC policy, procedures and control requirements applicable to day-to-day working, exceptional and project activities, and raise any concerns about actual or potential issues promptly, in line with reporting and escalation procedures.

- Continuously monitor and gather information to assess potential impacts and identify possible risks and opportunities for the business.

- Apply policies, procedures, practices and standards to their allocated tasks, taking responsibility for their own actions, to ensure the achievement of high levels of quality, effective risk management and regulatory compliance.

- Understand current processes and participate in discussions with Group/Regional parties in identifying gaps in policy

- Critically assess change requests, raise them appropriately with impact and benefits summary for review by Change board. Manage the end to end process till the decision for the CR is advised.

- Review training, communications and procedure related information.

- Support to implement recommendations made by internal / external auditors and external regulators in a timely manner.

- The role holder will ensure stakeholders are informed and their views are considered at all stages of execution.

- Work closely with various parties from Group, Regional and local teams including FCTM, FCC, WPB Risk & Contro(R & C) l, Digital Business Services (DBS)nd the various project steering committees and working groups.

- Deliver fair outcomes for our customers and ensure own conduct maintains the orderly and transparent operation of financial markets

- Strike a good balance between customer impact and financial benefits when understanding changes with regard to implementing new changes

- Individuals are responsible for their own effectiveness, development and results to become Specialist or Subject Matter Experts, where matrix management and understanding of Group strategy is expected. Their contribution is often as a technical/professional specialist in their field.

- Support achievement of the HSBC vision, values, goals and culture in personal behavior, actions and decision making.

- Take personal responsibility for understanding and agreeing performance expectations, completing the necessary mandatory training and developing the levels of capability and competence needed to be effective in the role.

- Contribute to team development, effectiveness and success by sharing knowledge and good practice, working collaboratively with others to create a productive, diverse and supportive working environment.

- Seek opportunities to work collaboratively across boundaries (e.g. with different teams, geographies, cultures etc.)

- Timely escalations of any challenges when execution of projects or during implementation of new Regulatory guidelines which has a Regulatory impact to the WPB business.

Knowledge & Experience/Qualifications

- Minimum bachelor degree holder in any fields & good command of English.

- Good understanding of CDD & AML & Sanction policies and process

- Ability to work collaboratively with different stakeholders.

- Confidence to interact with senior management

- Detail and change oriented.

- Strong judgmental skills & problem solving skills.

- Experience leading complex projects.

- Ability to work independently and under pressure without supervision.

- At least 3 to 5 year of working experience, preferably experience in WPB business / banking industry.

http://www.hsbc.com/careers

HSBC is committed to building a culture where all employees are valued, respected and opinions count. We take pride in providing a workplace that fosters continuous professional development, flexible working and opportunities to grow within an inclusive and diverse environment. Personal data held by the Bank relating to employment

applications will be used in accordance with our Privacy Statement, which is available on our website.

Issued by The Hongkong and Shanghai Banking Corporation Limited

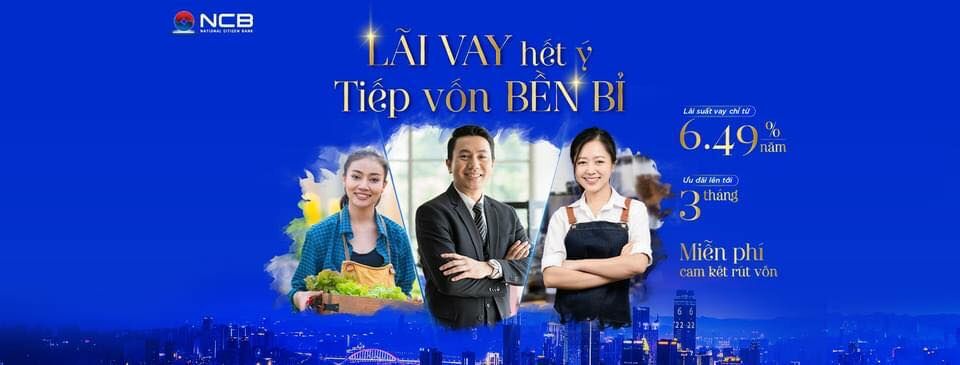

Ngân hàng TMCP Quốc Dân – NCB được thành lập từ năm 1995 theo Giấy phép số 00057/NH–CP ngày 18/09/1995 của Ngân hàng Nhà nước Việt Nam dưới tên gọi Ngân hàng Sông Kiên. Sau đó, từ một ngân hàng nông thôn, NCB đã chuyển đổi quy mô thành ngân hàng đô thị, đổi tên thành Ngân hàng TMCP Nam Việt– Navibank. Đến năm 2014, NCB chính thức được đổi tên thành NH TMCP Quốc Dân – NCB. Trải qua 28 năm hoạt động, NCB đã từng bước khẳng định được vị thế thương hiệu trên thị trường tài chính – tiền tệ Việt Nam.

Ngành nghề kinh doanh: Huy động vốn, tiếp nhận vốn, ủy thác, vay vốn, cho vay, chiết khấu các thương phiếu, hùn vốn liên doanh, dịch vụ thanh toán.

Chính sách bảo hiểm

- Được hưởng các chế độ như BHYT, BHXH, ….

Các hoạt động ngoại khóa

- Teambuilding,

- Các buổi giao lưu học hỏi

- Các trò chơi giải trí

Lịch sử thành lập

- Được thành lập vào năm 1995

Mission

-

Sau 28 năm hoạt động, sự phát triển Ngân hàng với nhịp độ tăng trưởng ổn định, an toàn đã giúp NCB có được niềm tin của nhà đầu tư, khách hàng và đối tác.

Những nghề phổ biến tại NCB

Bạn làm việc tại NCB? Chia sẻ kinh nghiệm của bạn

Tweet

Tweet

Facebook

Facebook

Copy Link

Copy Link